Much has been said in recent months about the opportunity that nearshoring represents for the economic growth of Mexico. In fact, some analysts, such as Alejandro Werner, a former official at the International Monetary Fund, estimated that nearshoring could add up to eight points of growth to Mexico’s GDP over the next seven years. Other analysts have also shown optimism, suggesting that Mexican exports, which represent a little over 40% of Mexican GDP today, could reach values greater than 50% of GDP in the medium term if the effect of nearshoring is strong for the country.

Let us remember that the phenomenon of nearshoring refers to the approach of production centers (mainly of multinational companies) to the final consumer, which is commonly the US market. These companies, for the most part, have production centers located in China, but may be considering relocating to another geographic area and Mexico could be a good option.

This relocation is due to factors such as:

- Geopolitical issues between China and the United States, which generate a climate of uncertainty for companies looking to the future.

- Geographic diversification in the production chain. The pandemic showed multinationals that having high concentrations of their production in China can have negative consequences, due to factors such as periods of isolation. That uncertainty remains latent.

- Logistics issues. Companies have learned that the boom in digital commerce requires immediate delivery of products to the end customer; that is, to ensure that they do not lose sales to their competitors, companies prefer to set up production centers closer to their consumers, thereby reducing delivery times.

Measuring nearshoring in Mexico

There are several ways to measure the effect of nearshoring in Mexico. One indicator could be the growth in demand for industrial parks and, another, the measurement of foreign direct investment (FDI) flows that have arrived into the country. Neither of both are perfect instruments for measuring nearshoring flows, but they both provide interesting information to estimate the magnitude of such flows

Regarding the indicator of demand for industrial parks, the Mexican Association of Private Industrial Parks (AMPIP) reports that, prior to 2022, on average at the national level, industrial warehouse space availability was between approximately 6% and 7%, while by 2022 this figure had dropped to 2%. Currently, in 2023, in some areas of the country’s northern border region, the availability is close to 0%. In addition, there are approximately 50 new industrial parks in Mexico in different stages of construction. According to AMPIP, just over 40% of the growth in demand for industrial parks comes from Chinese companies that have arrived into the country.. This indicator of industrial parks makes us think that nearshoring is real and is occurring more strongly in the north part of the country.

On the other hand, if the indicator of FDI flows that have arrived in the country is analyzed, the results regarding nearshoring to date are not optimistic. Let’s see why.

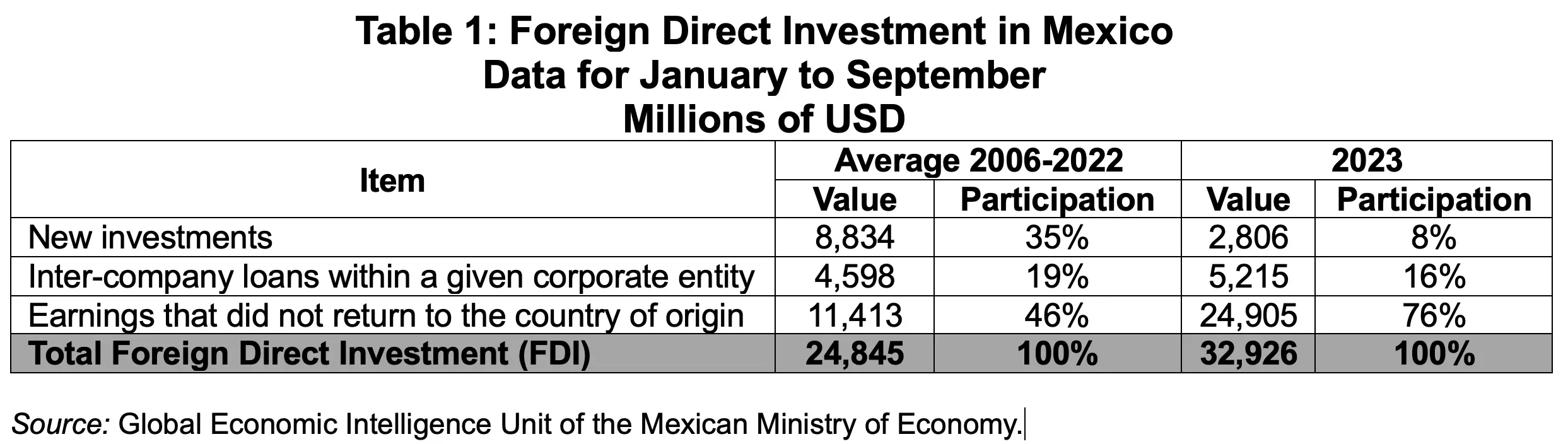

Table 1 shows that the total FDI that Mexico received from January to September 2023 was 32,926 million dollars (USD). This figure is 30% higher than the amount that was received in the same period of 2022[1], as reported by the Ministry of Economy, the federal government body in charge of reporting FDI arriving in the country. Up to this point, the FDI results appear to be very positive, but the growth becomes disappointing when we discover what sustains it.

Table 1 shows the components of the total FDI. For nearshoring purposes, new investments are the heading that should matter most to us, because it is the one most associated with the arrival of new companies into the country. However, the 30% growth in total FDI is due to the fact that companies already established in Mexico did not return their earnings to their country of origin, that is, they reinvested them in Mexico. Although this is very positive, the reinvestment of earnings is not nearshoring. In fact, it indicates that new companies are not arriving in the country, instead those already established companies have decided to reinvest their profits, perhaps for tax reasons or for the renewal of machinery, expansion, etc.

To measure what happened in each of the items that make up the total FDI, Table 1 shows a comparison between the amounts received from January to September 2023 and the average received for the same period from 2006 to 2022. For example, the results indicate that the average of new investments that arrived in the country between January and September from 2006 to 2022 was 8,834 million dollars, while, in the period from January to September 2023, this figure was 2,806 million dollars. That is, in the first nine months of 2023, new investments represented only 32% of those historically received in the same period from 2006 to 2022. Sadly, the flows received from January to September 2023 at a country level do not support the observed optimism because of the nearshoring phenomenon.

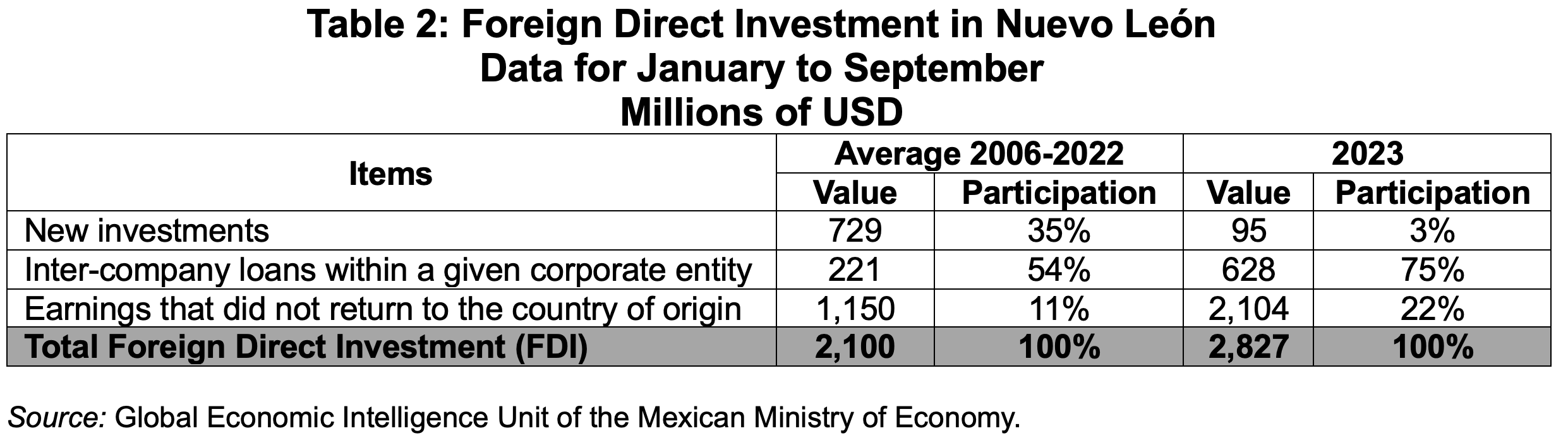

With regard to Nuevo Leon in particular, since it is a highly manufacturing state and with the announcement of the arrival of TESLA to the entity, investments were expected to begin to grow, considering this state an excellent recipient of investments from new companies. Let's see below what the figures say.

Table 2 shows that a total FDI of 2,827 million dollars arrived in Nuevo León from January to September 2023. This is a decline of 2.9% compared to the amount the state received in the same period of 2022.

Similarly, if the items that make up the total FDI are analyzed, the average of new investments received in the state in the period of January to September from 2006 to 2022 was 729 million dollars. However, in the period from January to September 2023, this amount was 95 million dollars, that is, just 13% of the average received historically in the same period.

Additionally, Table 2 shows that the items of undistributed profits and inter-company loans increased in 2023 compared to the historical average between 2006 and 2022. The increase in these two items reduced the decline in total FDI in 2023 to only 2.9% year over year.

The significant reduction in new investments, both in the FDI received at the country level and that received in Nuevo Leon, may be a temporary factor that does not reflect yet the arrival of the new investments into the country due to nearshoring phenomenon. However, it may also be considered as a warning sign that invites us to ask ourselves if, as a country, we are offering to foreign companies what they need to come here and produce.

We must understand very clearly that it is imperative that Mexico offers an environment of certainty in factors such as electricity, gas and water supply. At the current time, there is less than complete certainty for the investor that these resources will be always guaranteed here in the country. Additionally, public infrastructure improvements are required. As an example, exports at the country level have grown greatly in recent years, but the public infrastructure to transport goods and at border crossings has not changed, thus resulting in a large amount of congestion.

In addition, the level of insecurity in the country must be reduced, since this seriously affects the internal operation of companies and the transportation of goods. Insecurity should not be an indirect tax that companies have to pay, since in the end it seriously affects their competitiveness. We must be aware that, until an environment of certainty in the aforementioned factors is guaranteed, Mexico could stop attracting the investments that under other scenarios would have reached the country.

[1] Such growth of 30% is achieved by excluding from the 2022 data the extraordinary investments made for the Televisa-Univision merger and the restructuring of Aeroméxico.

The author is professor of Economics and Finance at EGADE Business School.

Article originally published in Alto Nivel.