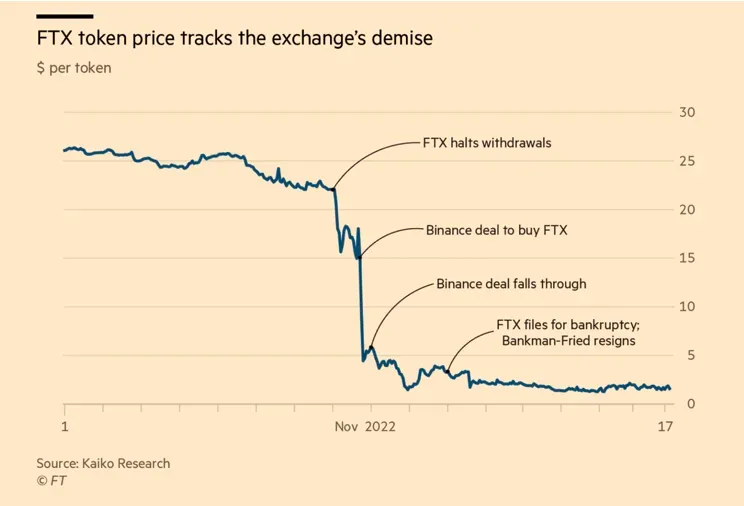

Public opinion was stunned by the implosion of the FTX platform given the amount involved and the speed of its collapse. In a matter of days the company went from being worth US$32 billion to filing for bankruptcy. Perhaps also because of the lesson learned from the failures of its founder, Sam Bankaman-Fried, who, on his own initiative, has lost everything. In this wild west, clamors for the presence of guardians of order, regulatory authorities, to protect small investors and avoid financial contagion, are already being heard. I can just imagine the authorities shrugging their shoulders and arguing that the issue of jurisdictions imposed limitations on their powers, that little could be done. However, there are several charges of omission or voids that are worth highlighting.

First, there is a conceptual void. An article published by Agustín Carstens, (“Money in the Digital Age: what role of central banks”), [1] as head of the Bank for International Settlements (BIS), pointed out that the high volatility of cryptocurrencies prevents them from being a viable substitute for money (fiat). How can we trust a medium of exchange whose price displays astronomical volatility? Quite honestly, I found this position, coming from the chief representative of central banks, quite unsatisfactory. The problem with an asset being widely accepted is that it endogenously generates a credit process. Someone deposits a cryptocurrency in an institution, and, in the absence of oversight, there is nothing to prevent the institution from lending that asset to someone else, and so on. This is the typical money-multiplier process. Or in its more up-to-date version, someone goes to an institution and asks for a margin loan. FTX even offered loans of up to 100 times the value of a crypto asset. In this situation of uncontrolled expansion, it is not difficult to imagine the case in which an event would give rise to uncertainty about the solvency of these lenders and trigger a financial run. In the case of FTX, its clients withdrew US$430.0 million in four days. The authorities' warning call should have been in this sense, explaining how the lack of supervision intensifies information asymmetry problems, and produces a cycle of instability, and not merely emphasizing the issue of volatility. The real danger of cryptocurrencies is that there is no lender of last resort to stop panic selling. The cases of FTX and Binance also illustrate why this lender should be a public institution. There are incentives for a private company to prefer that its competitors should go bankrupt rather than come to the rescue. Binance initially announced its intention to acquire FTX, but withdrew its offer a day and a half later, delivering the death blow.

Moreover, Carstens did little to clarify that, unlike the case of revolutionary Mexico, in which each revolutionary faction issued (imposed) its own banknotes, cryptocurrencies bear a greater resemblance to a securities offering. The authorities must oversee these issues to prevent fraud - a point that the US Securities and Exchange Commission Chairman, Gary Gensler, has repeatedly made.

This conceptual void not only overlooked the risks of cryptocurrency under-regulation, but has also prompted an agenda in another direction. Regulatory efforts focus more on the stability problems of the methods of payment and, therefore, on CBDCs (Central Bank Digital Currencies) than on the possible impacts of financial instability. Ex post, these problems have clearly become far more pressing. With all the runs that have been seen in crypto markets such as Voyager, Celsius, Terra-Luna, Three Arrows, FTX, as well as Genesis and Gemini, it comes perhaps as no surprise that this year's Nobel Prize was awarded precisely to Ben Bernanke, Douglas Diamond and Philip Dybvig for their work in this area.[2]

Secondly, the Fintech Law published in 2018 was an important benchmark that gives Banco de México a primary role in the supervision of cryptoassets. However, after that initial push, progress has been very slow. Once again, in these cases there are those who are glad of the lack of regulation that makes their operation in Mexico possible. Nevertheless, the opposite could also be argued: the lack of regulation has driven these activities to the edge in poorly regulated jurisdictions. Bitso, the main cryptoasset platform in Mexico, is licensed in Gibraltar. This same phenomenon was identified when analyzing the causes of the 2008 subprime mortgage crisis. Regulators evaded monitoring the emergence of new financial intermediaries until it was too late. Bloomberg’s editorial board sums it up as follows: FTX operated “in a regulatory void without any of the requirements of capital governance, liquidity, fund segregation, cybersecurity, or conflict of interest that traditional brokers have to meet,” leaving its clients unprotected. FTX has more than a million creditors.

Finally, some people think that since the cryptoasset bubble is coming to an end, establishing a regulatory framework will not be necessary. However, the forces that have driven the development of this market are still very much in evidence, while the authorities do very little to explain the risks of new intermediaries to the general public. It is becoming increasingly plain that the best supervised activity, banking –which consists of taking demand deposits and granting longer-term loans– is fading.[3] This can be explained by three factors:

- Regulatory costs are high and have diminished bank profitability. The supervision of financial intermediaries, the existence of a lender of last resort and the capitalization level have had a positive impact on the robustness of banks, protecting the sector from the onslaught of the COVID-19 pandemic. But these benefits entail very high costs and reduce bank profitability. Therefore, numerous monetary and intellectual resources are aimed at avoiding regulation.

- A progressively aging global population and higher life expectancy translate into more resources being allocated to pensions, significantly increasing the assets managed by pension funds and fund managers. Banks are simply no longer the “Lords of Money.” If you have wondered how the fintech companies that are going to take market shares from the banks are financing themselves, that’s your first clue. On the other hand, the younger generations are desperately looking for assets that will give them a more attractive return than bank deposits and assure their retirement. This is one of the reasons why cryptocurrencies have gained so much attention in this segment of the population.

- Globalization and digitalization have also intensified the competition for banking services. Recent geopolitical and health risks may have slowed down the global economic integration process. However, this phenomenon may possibly be more associated with trade in goods. The globalization of services, including financial services, has continued to rise. Digitalization has also brought greater competition from big tech companies to the sector.

From the above, we can conclude that if it is not cryptoassets, new business models will emerge that demand a better regulatory framework rather than waiting for a new crisis. Finally, it should be remembered that regulatory authorities have fewer financial and human resources than their private counterparts. If we want to have a better regulation that does not evade or postpone important decisions for the country's financial sector, strengthening them is essential. In Mexico’s current situation, where supervisory institutions have struggled for their independence –and even for their own existence– making demands on them and supporting them are of equal importance.

The author is professor at EGADE Business School and CFO of Flatstone Capital Markets.

[1] https://www.bis.org/speeches/sp180206.pdf

[2] https://www.nobelprize.org/prizes/economic-sciences/2022/summary/

[3] https://bpi.com/assessing-the-decline-in-bank-lending-to-businesses/