The global impact of COVID-19 on our health, economy and social spheres is also significantly affecting markets in all regions of the world. Although the virus is more dangerous than the ordinary seasonal influenza, it should not be compared to the 1918 Spanish Influenza. However, disturbances in day-to-day life in the short term will be severe, as households and businesses react - perhaps, in some cases, with understandable exaggeration - to minimize the possibility of infection and to ensure that people can continue their activities under normal circumstances as soon as possible.

In view of the crisis we are dealing with, we must weigh three different dimensions before we can offer an accurate forecast of how the variables at stake will manifest in Mexico and the rest of the world: One is the disease itself, the second is the economic effect it will cause, and the last is the effect on the stock market and the expanded financial system.

An additional aspect to be considered is that, as soon as the first signs of recovery arise, the markets, followed by an economic upturn, will prompt a response that is truly as drastic as that of the downturn. That is the difference a single day can make in the human mind. This forecast is based on two highly verifiable facts. First, the fact that governments in all countries will provide sufficient and ambitious fiscal and monetary stimulus - the outcomes of which will have to be managed later - as a result of the havoc wreaked by the COVID-19. This will ultimately have an impact on the most affected sectors and then expand to the overall economy. Second, there is the fact that a virus has never been the driver of a traditional recession, but of a transitory shock. Hence, we can expect that purchase intentions and investments on behalf of households, banks and businesses will remain intact and will merely be postponed; furthermore, the relative financial stability of these sectors should give us comfort that this will be the case.

I. Consequences and characteristics of the disease

As for the consequences, after analyzing many other cases in history, from the Spanish flu of 1918 and all those that have followed (see Appendix 1), most of the effects of all these diseases reach a peak of contagion and deaths (specialists expect to see this peak in early May), yet this starts to decline when the population becomes naturally immune as a result of exposure, and by finding a cure.

COVID-19 is a form of SARS[1], similar to the one in 2002 and 2003 in Hong Kong, which was also caused by the consumption of a feline in China. Its mortality rate is relatively low and close to 3.5% (greatly varying by age and geography[2]), - which is still 35 times more lethal than seasonal influenza - yet MERS had a rate of 34% and SARS had 9%. When compared to other serious diseases in the number of deaths per day in the world, Hepatitis B still has a rate of 2400 deaths per day, Pneumonia 2200, AIDS 2100, Rotavirus 1200, Seasonal Influenza 1000 and COVID as many as 70 deaths per day so far.

Another distinction of this pandemic is that, while seasonal influenza has an R0 (basic reproduction number) of 1.3 - which is the average number of people infected by each carrier-, Coronavirus has an R0 of 3. It also differs in that it incubates slowly even if it does not show any symptoms in up to 20 days,- which makes it even stealthier and more dramatic- as opposed to the average 2 days in the case of influenza. Moreover, Coronavirus can still spread - remain active - for up to 4 weeks, compared to the 1 week of influenza. Doctors even get infected (and die) in the case of COVID-19 and this is very rare in the case of influenza.

In conclusion, this outbreak is no common flu, as it is more aggressive, but it seems to be neither the most deadly, nor the most contagious, and not even the quickest to spread (in contrast to other outbreaks in history). However, it has taken the whole world by surprise, especially vulnerable countries, in at least four issues: A deficiency of their public health systems, a relaxed and unreliable culture with high rates of smoking and an aging population, which typically has additional exacerbating conditions for this virus such as high blood pressure, respiratory complications, diabetes and overweight.

Because of this, the countries that are best prepared to face the virus are China, Germany and South Korea and the worst are Italy and the emerging countries as a whole (although, the southern hemisphere, because of its temperature and the humid climate, has a better fighting chance since the virus is unable to survive at temperatures exceeding 26°C). Between these two extremes are the USA and Central Europe.

Lastly, the fear caused by the epidemic itself comes from the impact that social media and technology have had on each of us. During SARS, for example, references to the disease appeared on the Internet and the media about 63 million times, whereas now, COVID-19 has been mentioned 2100 million times, which is 33 times fold. This is one of the reasons why the effect on the real economy and financial asset prices will also be far more severe, some experts even predict that it will be similar to the 2008 crisis.

II. Foreseeable economic repercussions

It is expected that the economic repercussions will have a strong impact on supply and demand in the short term, leaving only medium-term repercussions, but not long-lasting ones, and that, even at its worst scenario, the recession will be followed by an upturn of the same magnitude after three quarters. These repercussions will be stronger and are likely to last longer in China, a country that will be twice scorned (due to the harmful aspects of its industrial policy and the concerns about its fragile health culture), followed by those countries that have been forced to implement a social fence for a longer period, such as Italy, and the countries that are more vulnerable to China-centred manufacturing value chains, such as the USA and Germany.

The virus’ repercussions, from an economic point of view, can be classified into three categories: The first - in terms of demand - is the one that comes from consumption and investment decisions in response to the pandemic. The second is that which stems from forced social distancing as a palliative measure to avoid contagion. The third is the disruption and possible fracture of supply chains - a supply-side effect - that comes as a consequence of the previous issue and of delays on behalf of China, a country that has been the most important link in global manufacturing for at least two decades.

The repercussions on demand and investment will bring caution in both, or at least, some delay. Durable goods will have to be postponed, but some basic goods will see peaks in demand, such as cleaning, health care, and household products, along with stationery products. As for the second category, all those suppliers that enable people to stay away from large crowds (such as home delivery, internet services, computer equipment, entertainment, virtual meetings, assisted manufacturing, etc.) will see a strong peak in demand. But, as for the effects on supply, there will be serious delays in those production processes that are highly dependent on human design and supervision, as well as the entire economy of services that require a “face to face” presence such as restaurants, hotels, transportation, sports and mass entertainment activities, customer service in supermarkets and smaller services (such as those provided by mechanics, tailors, technicians, hairdressers, etc.); the education and health sectors will be affected in its routine and extraneous methods.

These first two repercussions will last as long as the halt in operations, from a “standard” to a “restricted” status, and will then recover, with possible peaks due to the delay in demand, once the normal status is restored (except for “on-the-spot” services, such as restaurants, which will lose the entirety of their income during those months). However, the third category could spread further as the repercussions are much more permanent: Inputs for production are subject to transit interruptions or drastic changes in prices, thus stopping value-added production, which leads to overproduction, layoffs and falls in the real economy, which will extend beyond manufacturing.

The economic effects of outbreaks have had a low impact throughout history, regardless of mortality rates, although reactions are often emotional and the consequences of the lack of certainty are usually very expensive, but temporary. The 1918 Spanish flu (which broke out in West Point, USA, when the soldiers returned from the 1st World War) is the worst possible scenario, and it showed the following pattern: while in 1919, the USA's GDP reported zero growth, and in 1920 there was a downturn of -2% of GDP, the economy had a vigorous upturn in the following decade.

The only factors that would make a noticeable difference compared to previous cases in history are those related to the issues that the global economy was already dealing with prior to the outbreak. Populist outbursts - which stem from a decades-long sense of abuse inflicted by the elites on the masses- is another pungent ingredient that would surely contribute to a major clash, if those factors were to be combined. The fact that the tools for economic relief (expansive monetary and fiscal policies) have limited scope to navigate in almost all G20 countries is not helpful either.

III.The Effect on Stocks and Financial Asset Markets

Stock markets have plunged 30% since their peak on February 28 and, at the time this report was written, virtually all markets in the developed world have crashed. On Monday, March 16, fluctuations reached almost the same peak - at 80% - as they did in 2008, during the great recession caused by the collapse of the housing market twelve years ago. These effects are expected in a scenario as severe as that of the COVID-19, just as it is expected to have a “V-shaped” recovery or, at worst, a “U-shaped” recovery (which represents a longer but moderate slowdown before returning to the economy’s previous state).

The effects on stock markets and asset prices - including government bonds, corporate bonds and commodity prices - during many outbreaks in the past have followed the aforementioned behavior, with some rare exceptions experiencing an “L-shaped” effect for a while (a recession that lasts for more than 24 months). But, because of the circumstances of the financial markets prior to this crisis (where there was plenty of cash available, high levels of liquidity, prompt responsiveness from governments and monetary authorities, high levels of debt but very low-interest rates, and with most markets staying away from asset bubbles), this scenario is unlikely at this point, but not impossible.

It is also expected that the earnings per share (EPS) from the Standard & Poor's 500 index (SPX), which are now close to 154 USD, will fall by up to 10% this year due to the recession and, based on the poor average P/E Ratio (price-to-earnings ratio) of previous crises caused by outbreaks, we will hit the lowest levels of the SPX at around 2000 points[3].

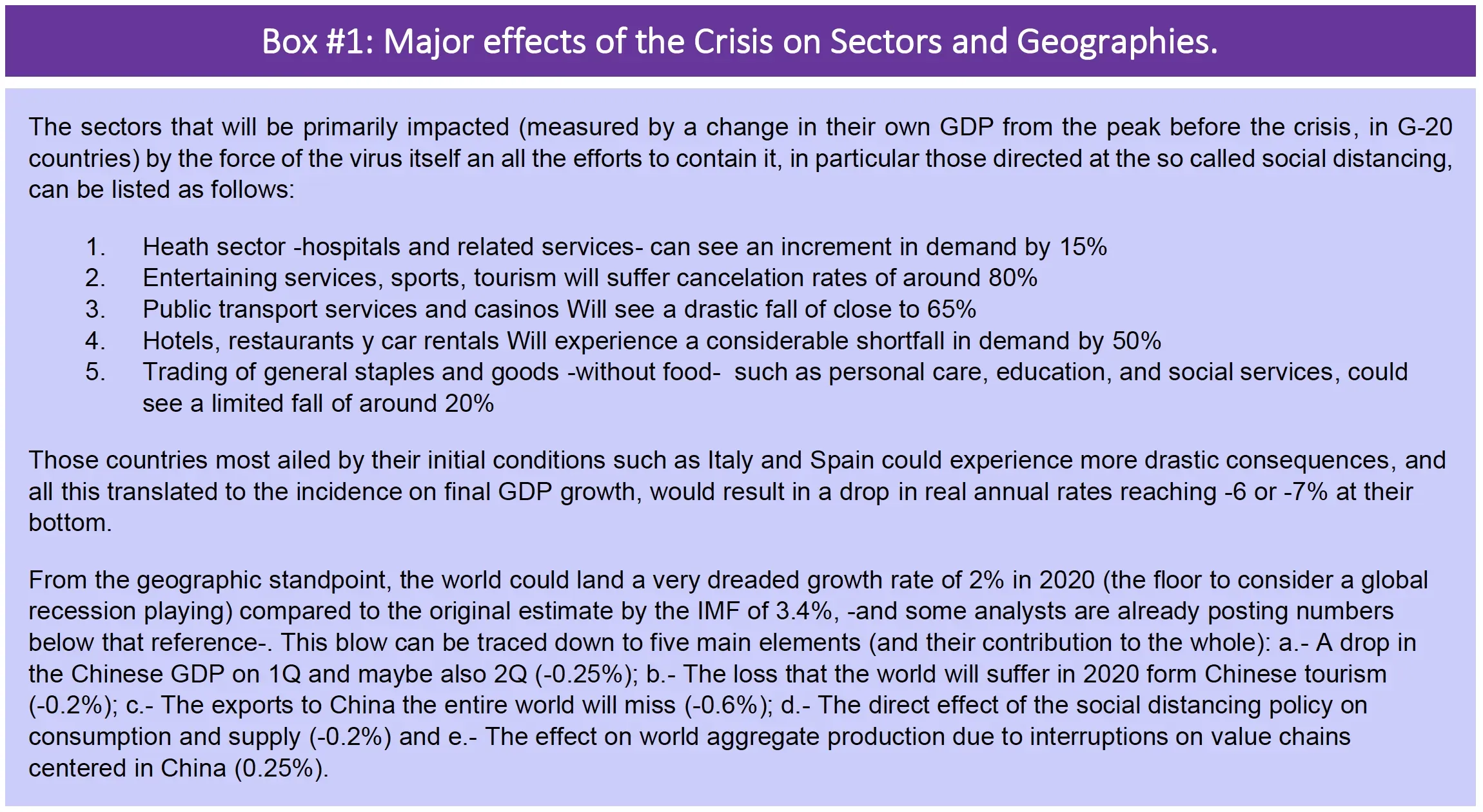

Nevertheless, the effect of the drop in revenues and profits of those companies that are more vulnerable to the crisis may be significant -either because of their leverage or because they are a vulnerable sector as mentioned in Box #1- and they could experience drops in their shares by up to 60 or 80%, something that some airlines have already experienced at this point. Several of these companies will pose a buying opportunity - as the market will make no entry distinction since it will drastically react with aggressive sales - and others will have to be drained or acquired by the strongest players.

As for the response of the monetary authorities, there is no doubt that the measures taken so far[4] are aimed at providing liquidity and reassurance to investors. However, it also sends a clear signal of panic in the boardrooms of central banks, something that will hardly help the stock market run or might even make it worse, just as the futures market has demonstrated on both of the times in which the Fed intervened. In countries where this is not an option, such as those in Europe, fiscal policies will be deployed in TARP or LTRO type of programs, just like in 2008, providing direct relief and incentives to companies (as banks remain strong so far and at less risk compared to companies in vulnerable sectors).

IV. Implications for Mexico and Final Thoughts

The oil war between the USA, Saudi Arabia and Russia creates further obstacles for the Mexican economy, which was already in a technical recession (meaning 4 quarters of consecutive negative growth up to December 2019), reaching a scenario that has been called “a perfect storm”.

The number of confirmed COVID-19 cases at the time of writing this report was 82, but most observers suspect that this number is higher, as Mexican authorities, under the banner of President Andrés Manuel López Obrador's administration, are said to have “empirical professionalism”, to put it mildly. As proof of this, according to the minutes of meetings with U.S. health officials, it was concluded that the testing and screening processes in Mexico and at its ports and borders were below the standards recommended by the World Health Organization and even below of the most basic - and reluctant- practices in the USA. Therefore, we can assume that initial measures might be very sloppy, which could delay the fight against the virus by at least three weeks. On top of this, Lopez Obrador's war against corruption has resulted in him dismantling the Mexican health insurance system and drastically changing the distribution channels for medicines in the public health system, which has led to shortages and serious deficiencies in hospitals and health clinics.

As for the impact on the economy, we can expect that a drop in the American GDP will have twice the impact in Mexico, meaning that a -2% drop for the USA could translate into a -4% drop for Mexico. The main sources of revenue are exports to the USA, which constitute 80% of all exports, and tourism, which represents 9% of Mexico's GDP. In addition to this, the drop in oil prices directly affects the public spending budget by 18%[5].

The peso has lost about 20% of its value, which will affect private firms that have debts in dollars, but not the government, whose debt is 78% in pesos and 81% at a fixed rate. Although, Pemex does have most of its debt in dollars, so it is very plausible that the company will suffer further depreciation soon, since, with this price reduction, 75% of its oil fields are now below the cost of extraction, which will most certainly have an impact on the sovereign debt's UMS bonds, a fact that could also affect the stock market and interest rates.

However, there is still a silver lining and that is the fact that China, due to the double challenge referred to in the previous sections, will lose the upper hand in terms of investment in manufacturing, leading the manufacturing world to redirect its supply chains to less risky and otherwise viable geographies, and Mexico, of course, will emerge as a major winner in this regard, no sooner than the next eighteen months, once this whole crisis clears up, as everything always does.

%2013.19.34.png)

References

1. Backhaus, Andreas. “Coronavirus: Why It's so Deadly in Italy.” Medium, Medium, 15 Mar. 2020, medium.com/@andreasbackhausab/coronavirus-why-its-so-deadly-in italyc4200a15a7bf.

2. “Coronavirus Disease (COVID-19) - Events as They Happen.” World Health Organization, World Health Organization, www.who.int/emergencies/diseases/novelcoronavirus- 2019/events-as-they-happen.

3. Carlsson-Szlezak, Philipp, Martin Reeves and Paul Swartz.“How to Think Through the Economic Impact of COVID-19”. BCG Henderson Institute. 3/1/2020.

4. “COVID-19 Briefing Note. Global Health and Crisis Response”. McKinsey and Company. March 16, 2020.

5. LePan, Nicholas. “Visualizing the History of Pandemics.” Visual Capitalist, 16 Mar. 2020, www.visualcapitalist.com/history-of-pandemics-deadliest/.

6. McCandless, David. “COVID-19 #CoronaVirus Infographic Datapack.” Information Is Beautiful, Information Is Beautiful, 17 Mar. 2020, informationisbeautiful.net/visualizations/covid-19-coronavirus-infographic-datapack/.

7. Pueyo, Tomas. “Coronavirus: Why You Must Act Now.” Medium, Medium, 17 Mar. 2020, medium.com/@tomaspueyo/coronavirus-act-today-or-people-will-dief4d3d9cd99ca.

8. Robles, Pablo. “Decoding Covid-19.” South China Morning Post, multimedia.scmp.com/infographics/news/china/article/3075382/decoding-coronaviruscovid- 19/index.html?src=social.

9. Oppenheimer, Peter. Global Macroscope. “Bear Essentials: A guide to navigating a Bear Market”. Goldman Sachs. 9 March, 2020.

10. Woodard, Jared. “The Rational Investor´s Guide to Coronavirus”. BofA Global Research. 13 March 2020.

[1] There are over 200 varieties of coronavirus, but only 7 of them affect humans. Four of them are endemic respiratory viruses and cause 15-30% of common colds each year. SARS and MARS are considered to be epidemic. COVID-19 is newest and is considered to be a pandemic.

[2] The mortality rate in people over 80 is 15%, but for people in their 50's, the rate drops dramatically to 1.3%; if they are in their 70's the rate is 8% and if they are in their 60's, 3.6%. The mortality rate in Italy is above 6% on average, compared to 0.6% in South Korea, largely due to the age of its population. On the other hand, there are diseases that are transmitted to more than 5-8 people and with mortality rates of 40-60%, so in comparison COVID-19 is moderately aggressive.

[3] This stems from an EPS of 154, with a 10% discount to produce 139 USD per share, multiplied by a P/E of 14x or 15x, which produces a range of 1940 to 2080 points, still between 300 and 400 points below the closing price at the time of writing this report, with an overall drop of 38-43% as a result of the crash.

[4] Quite in the style of the 2008 relief measures, we will see significant increases in QE from all central banks in developed countries, well beyond target rate cuts in those that could still be met, such as the Fed, which has already cut its target rate by two hundred basis points over the last ten days, one of which was on Sunday.

[5] The government takes that percentage from Pemex's sales, which has a coverage that will be worth 158 billion pesos (which is only about a fifth of the production of 2020), but represents less than 3% of a total budget of 6.1 trillion pesos.