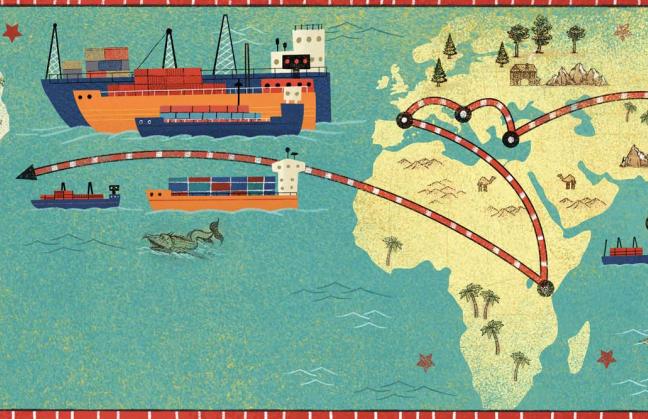

Will Latin America become part of the New Silk Road?

We analyzed whether the Latin American nations are good candidates to become part of the ambitious Chinese New Silk Road Program (also known as the Belt and Road Initiative), and Chile, Peru, Panama, and Mexico offer the best possibilities for success

Despite the signs of a slowdown in the Chinese economy, the influence of this superpower continues to grow in Latin America. The vacuum left by the commercial and investment withdrawal of the United States (US) from the region and its protectionist policy is being exploited by China, a country that invested more than 99 billion dollars in 2014 and whose trade with the region has grown exponentially over the past decade, currently exceeding 300 billion dollars.

Until recently, the strategy of the Asian giant in Latin America was based on signing specific agreements with countries that are rich in natural resources, but in need of infrastructure and investment under favorable conditions. However, the recent inclusion of Panama in the countries that form the New Silk Road – a network of institutional, commercial, investment and infrastructure agreements designed to connect the territories of the Old Silk Road, as well as other geostrategic areas – reflects China's willingness to strengthen ties with more Latin American countries, thereby eroding US hegemony in the region.

This ambitious project, also called the "Belt and Road Initiative" (BRI), has already been signed by more than 90 countries around the world, especially in Asia, Africa, and Eastern Europe. According to the World Bank, it concentrates 30% of world GDP, 62% of the planet's population and 75% of global energy reserves.

While Latin America does not formally participate in the BRI, Chinese Foreign Minister Wang Yi referred to the region as a "natural extension" and an "indispensable participant" of the program. Chile, Peru, Argentina, Brazil, and Venezuela are already preponderant business partners of China and experts warn that, if they have not yet joined the New Silk Road, it is because of the objections that could arise in the US.

But how well positioned are Latin American countries to join the initiative? It is difficult to determine since it is a project that lacks a homogeneous pattern of collaboration, although it maintains an open-door policy for any government that wants to join and current instruments for measuring its performance. It is also criticized for its lack of transparency.

To understand whether Latin America has the potential to become the East Wing of the BRI, and, above all, whether it can make a positive contribution to the project, we at EGADE Business School created a tool that evaluates the individual participation of member countries. Given the heterogeneity of the nations that are part of the New Silk Road and the lack of official information, the best way to address the issue was to make a comparison of countries.

In our research “Latin America: The East Wing of the New Silk Road” published in Competition and Regulation in Network Industries, we compared a group of ten current BRI members with ten Latin American countries, as indicated below. We tried to ensure that each group had a similar composition, regardless of GDP, per capita income, market size or population.

Group of BRI member countries: United Arab Emirates, Indonesia, Kazakhstan, Laos, Myanmar, Pakistan, Russia, Singapore, Thailand, and Vietnam.

Group of Latin American countries: Argentina, Brazil, Bolivia, Colombia, Chile, Ecuador, Mexico, Panama, Peru and Venezuela.

We identified five collaboration variables, which correspond to the main pillars of the BRI, and assigned them two measurement criteria:

- Political coordination: Free trade agreements signed with the PRC and presidential visits

- Facilities connectivity: Logistics competitiveness and infrastructure

- Unimpeded trade: Ease of doing business and trade coefficient

- Financial integration: Central government debt and sovereign credit rating

- People-to-people bonds: International mobility and Confucius Institutes

In this way, we were able to verify that there are no significant differences between the member countries and the Latin American countries, the latter therefore being good candidates to constitute the East Wing of the new Silk Road. Latin America urgently needs investment in infrastructure and financial instruments to maintain its position but it is likely that, at the current stage of development of the BRI, investments that mainly come from large Chinese public companies will be channeled through private Chinese companies that compete with their local counterparts.

According to the analysis carried out, Chile, Peru, Panama and Mexico offer the greatest chances of success as candidates to become part of the New Silk Road. Additionally, a number of other Latin American nations have the potential for integration into the project in the medium term.

Joining the BRI is easy, maybe too easy for any government. But, although this plan can offer multiple advantages to countries, it also has a dark side. The countries that aspire to join this initiative and the People's Republic of China would benefit from having an instrument that evaluates the strengths and weaknesses of candidate countries, thus reducing risks such as debt default. However, critics of the project identify certain disadvantages, such as China's excessive leadership position or neo-colonialism, damage to the environment resulting from infrastructure construction, doing business with corrupt governments or unreliable allies, and encouraging indebtedness in impoverished nations.

However, this kind of Marshall Plan, which bears the personal seal of President Xi Jinping, could be positive for Latin American countries in a context of economic stagnation and declining foreign direct investment in the region.