International Trade and Logistics in Times of Geopolitical Turbulence

The main challenge facing companies engaged in international business lies in managing their strategic decisions

The global market moves more than $1.2 trillion annually, according to the U.S. Department of Commerce. Achieving this scale requires a vast number of companies dedicated to importing and exporting—not only multinationals, but businesses of all types and sizes. More importantly, it requires a framework of globalization, which today is under pressure and must be carefully managed by organizations seeking access to this market and competitive advantage.

Most companies have weathered political and economic turbulence, especially since the 2007–2011 economic recession. In the most recent period—what can be termed “guarded globalization”—governments in developing countries have restricted the establishment of new industries to protect domestic companies. International firms have only been permitted to invest in certain sectors such as energy, environment, oil and gas, and large-scale technology projects, excluding financial services, agriculture, textiles, pharmaceuticals, and retail.

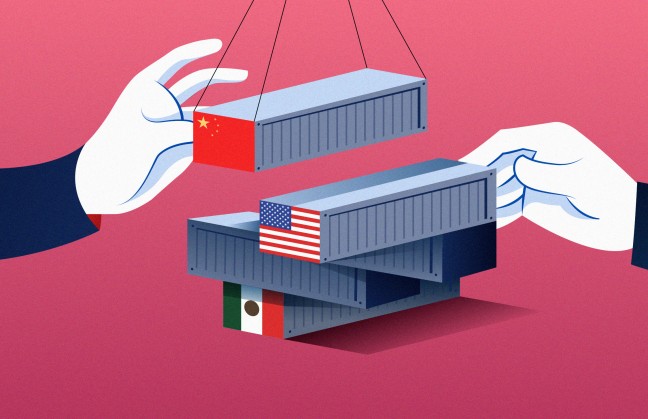

Trade liberalization has been heavily criticized by protectionist ideologies, which among other concerns, condemn the replacement of local labor with low-cost labor from developing countries. The America First agenda in the United States is a clear example of this skepticism toward globalization. It is evident that the political positioning of global trade powers influences key sectors of the economy and contributes to the design of national and international policies, strategic alliances, and business financing. A case in point is the United States-Mexico-Canada Agreement (USMCA), which has recently come under pressure due to Trump’s trade policy shifts.

In this context, changes in trade agreements profoundly affect companies that import and export goods and services. International negotiations often focus on technical standards, rules of origin, anti-dumping measures, subsidies, countervailing measures, and other liberalization and deregulation proposals (including privatization), as well as subregional, regional, and hemispheric integration processes. Global trade is also influenced by the simplification of customs rules and procedures, such as inefficient infrastructure, customs valuation, inspections, and import licensing. These customs-related challenges can be particularly complex for small and medium-sized enterprises (SMEs), which often lack the experience and resources to manage them effectively.

In my recent book Decisions in International Trade and Logistics: Corporate Diplomacy Strategies, and Operations (Palgrave MacMillian, 2025), co-authored with Vladimir Zlatev of Boston University, we discuss the impact of changing political philosophy and international business diplomacy on the strategic decisions of the firms engage in internatonal trade and logistics. New tariffs regime and export-import restrictions significantly affect the global supply chain including logistics and inventory disruptions, which escalate the global market turbulence. The book broadly analyzes economic, managerial, and behavioral aspects, along with macro and microeconomic theories, international financial strategies, PESTEL factors (political, economic, social, technological, environmental, and legal), entry modes, import-export strategies, marketing mix decisions, and organizational design for international business. This book opens several underlying questions on international trade and logistics as delineated below:

- How is international trade affected by the changing global diplomacy and transitional economic scenarios across countries?

- Based on the contemporary politico-economic environment, what are the right indicators and processes for engaging in exports and imports?

- How can firms manage decision making under political, economic, and market uncertainty?

- How to analyze the market ecosystem of both home and destination markets for making appropriate decisions on developing end-user markets for imported products?

- How to manage probabilities and risk factors on pricing and supply chain disruptions?

- How to manage consignment in transit, inventory, and logistics operations using information and communication technology?

The case studies on USMCA, Maqiladoras in Mexico, IMF surveillance on Argentanian economy, debt of Greece negative macroeconomic effects in Japan, US-China trade Relations during the late 2020’s, make in India program enables readers to navigate through the real glimpses of international business diplomacy and global-regional trade relations.

A New Trade Framework in North America

In our book, we examine the case of the United States-Mexico-Canada Agreement (USMCA), which replaced NAFTA in 2020 and redefined trade rules in the region. The treaty aimed to modernize economic relations and promote growth for workers, farmers, ranchers, and businesses across the three countries. Key innovations include updates to rules of origin for automobiles, the inclusion of digital trade and anti-corruption provisions, and new chapters focused on supporting SMEs. The agreement also promotes more efficient and transparent customs practices and reinforces commitments to environmental protection and gender equity in trade and investment opportunities.

Despite Trump’s recent changes to tariff policy, Mexico’s automotive industry has benefited significantly from the USMCA, leveraging the country’s comparative advantages—labor costs, workforce availability, and logistical infrastructure. The combination of low manufacturing wages, a semi-skilled labor force, and a favorable location has led to the establishment of U.S. automotive plants in Mexico. This favorable environment has allowed many companies to reduce production costs through maquiladoras, which benefit from tax exemptions and duty-free importation of inputs.

The USMCA introduced stricter regional content and labor value requirements in the automotive sector to encourage new investments in North America. New rules mandate a higher percentage of locally sourced materials, as well as the use of North American steel and aluminum in vehicle manufacturing. The agreement also incorporates labor value rules to ensure better wage conditions while reducing administrative burdens for automakers and parts suppliers.

The Maquiladora Model

The maquiladora model, developed in Mexico to take advantage of shared manufacturing contracts, was strengthened by NAFTA and later by the USMCA. These facilities allow foreign companies to benefit from available land, competitive labor costs, and favorable conditions for foreign direct investment. Through this model, Mexico has become a strategic destination for export-oriented manufacturing, helping U.S. and Canadian companies lower logistics and operational costs.

Despite its expansion—with more than one million jobs created and nearly 3,000 plants operating as of 2022—maquiladoras face challenges from international competition, particularly with China’s rise as a manufacturing powerhouse. Global economic crises, internal structural reforms, and shifts in international trade policy also pose risks to the stability of this production model.

To strengthen their position, maquiladoras will need to adopt more resilient business strategies, improve their responsiveness to financial crises, and enhance their international trade operations. It will also be crucial to explore policy alternatives that ensure long-term competitiveness, adapting to emerging requirements for sustainable trade, technological innovation, and economic diplomacy demanded by the global market.

El autor is Professor in the Department of Marketing and Business Intelligence, EGADE Business School.