Is the profitability of Mexican Pension Funds in free fall?

Mexican Pension Funds, called Afores, are not doing a good job, because the different participants in the system have a great deal of work pending

Are the Afores doing their job well? Does your advisor visit you regularly to give you recommendations on what movement(s) to make among the various retirement funds available (called Siefores)? Do you receive complete information in your account statements indicating in which instruments your contributions are invested? If your answer to all the questions above is affirmative, it is probably because you do not live in Mexico.

What is the situation with the Siefores?

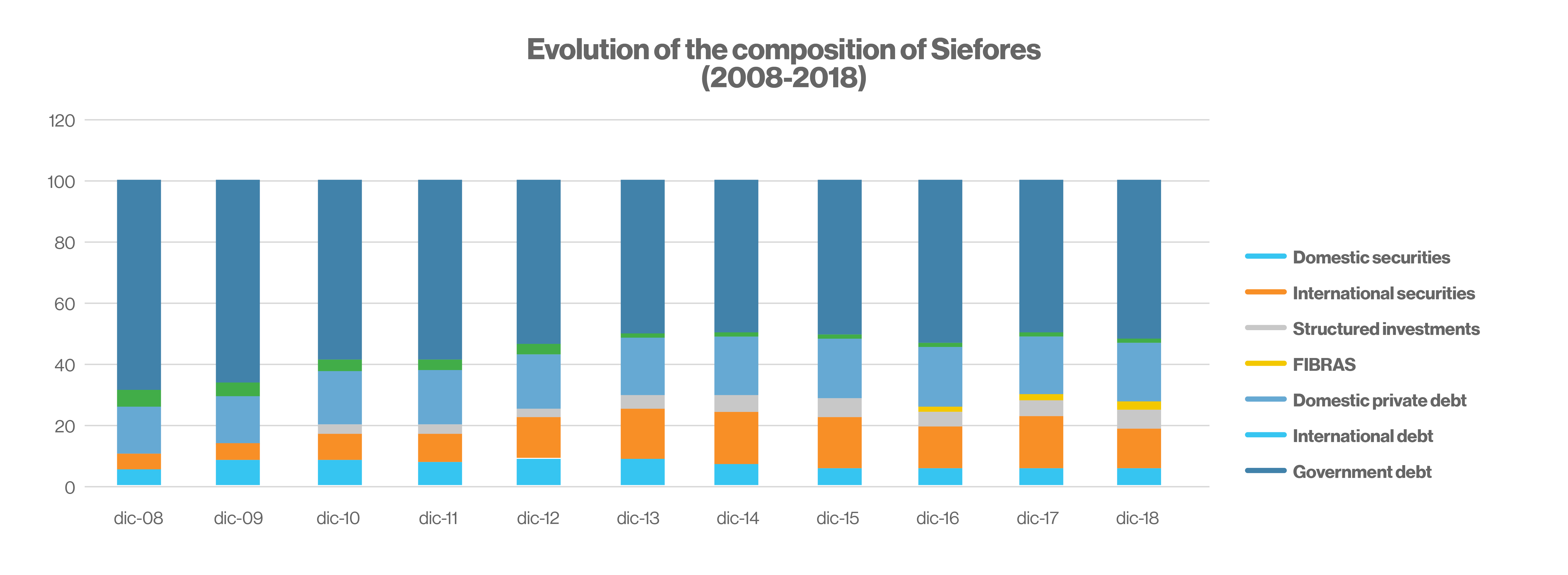

Currently, contributors can select from a menu of five Retirement Fund Investment Societies (Siefores) according to their age. Nothing prevents participants from changing their Siefore, but with the scarce financial culture that exists in Mexico, what usually happens is that they stay almost permanently in the Siefore they were assigned originally. The following graph shows that the Siefores suffer from rigidity, that is, they have hardly changed their composition over the past 10 years. The main difference between the various Siefores is the proportion of their assets invested in Mexican government securities.

Source: CONSAR own information and calculation

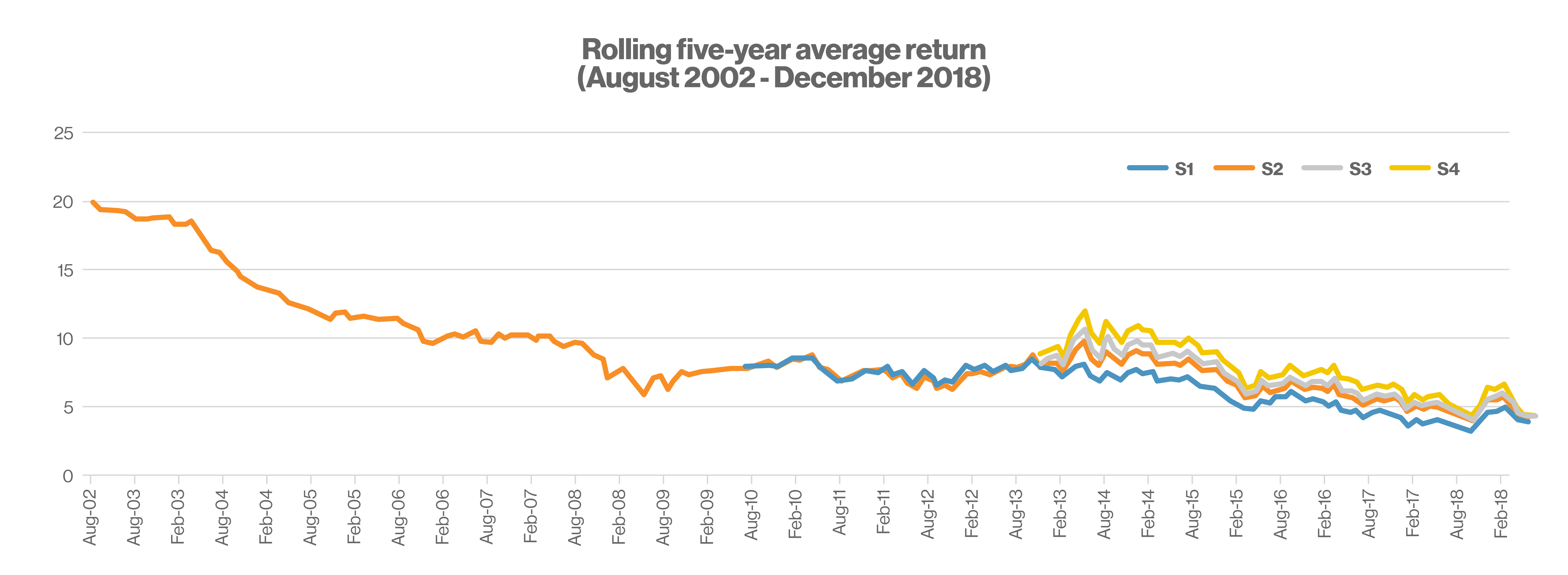

DDue to the rigidity in their composition, and even more so in their investments, the Siefores have been unable to offer increasing returns; in fact, quite the opposite: their accumulated returns have been decreasing. Although five-year returns have been positive for the 11 administrators (Afores) of the five Siefores, returns have been decreasing, from an average of 19.75% in August 2002 to an average of 4.85% in December 2018, as shown in the following graph.

Source: CONSAR own information and calculation

Does union lead to strength?

No less important is the fact that there is little difference between the 11 Afores (now 10) with regard to their investments and resulting returns. However, we should expect significant differences between Siefore 4 (where the largest proportion is invested in securities) and Siefore 0 (where everything is invested in fixed income instruments).

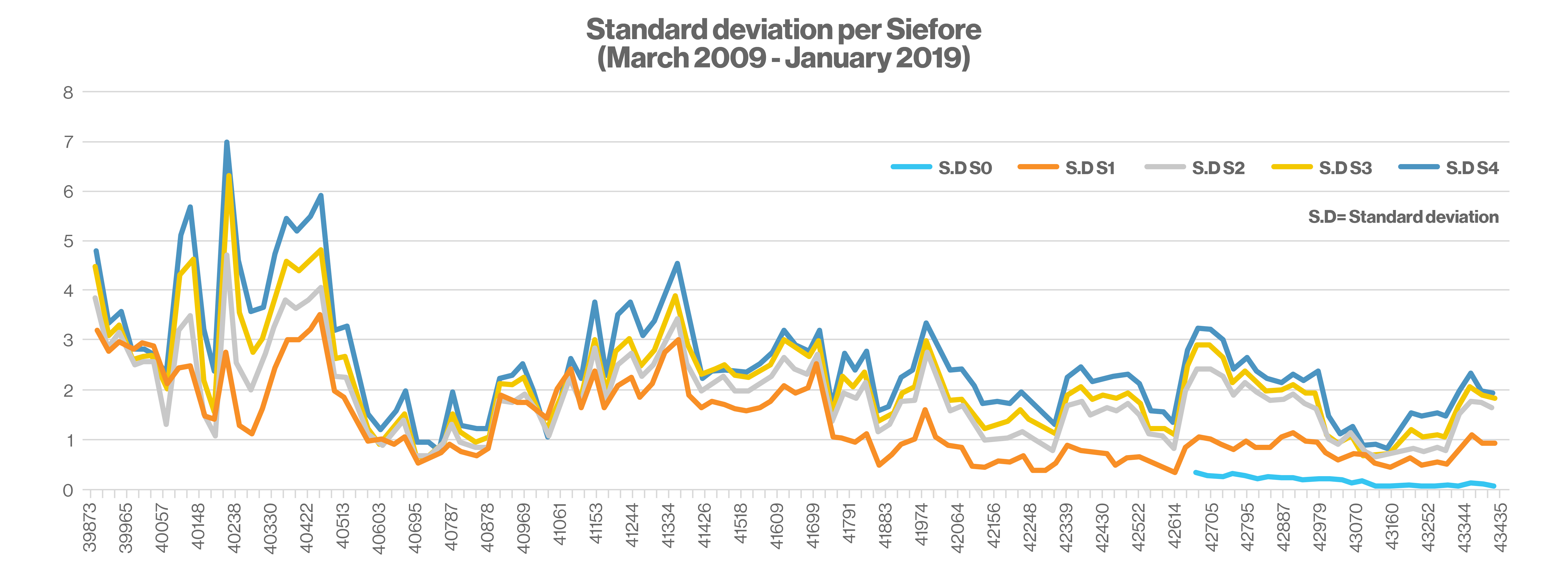

Actually, this is not so. The following graph shows how different the returns of the 11 administrators are for each Siefore. If all had a standard deviation of zero, it would imply that they all invest in the same instruments; the higher the standard deviation, the greater the difference in the way they invest. Over time, the standard deviation has declined, which indicates that they have been investing in an increasingly similar way. This is not in accordance with the efforts of the National Commission for Retirement Savings (Consar) to introduce a menu of more and more different instruments from which the Afores can choose to invest.

The most interesting aspect of the Afore investment pattern is that the returns obtained are strongly associated with the 11 administrators’ different ways of investing (standard deviation). Thus, for Siefore 1, each 1% increase in the standard deviation of the yields obtained by the Afores translates into 0.52% more yield to the contributors; Siefore 2 would translate into 0.40% more; Siefore 3 into 0.46% more; and Siefore 4 into 0.55% more.

Certainly, it is easier to justify the declines if all Afores invest more of less in the same instruments in each Siefore, but does this benefit the contributor who pays a fixed commission regardless of the yield obtained?

Source: CONSAR own information and calculations

All causes have effects

Given this scenario, it is not surprising that in January President Lopez Obrador presented an initiative to Congress to modify the law that regulates Afores. His proposal includes two important changes: reducing the number of Siefores from five to one, that will be called the Specialized Investment Fund for Retirement Funds (Fiefore); and allowing the Fiefore greater freedom to invest in new instruments and therefore to charge two commissions: for managing the account of each affiliate (which is the commission they currently charge) and for the performance or profitability obtained.

The first measure does not affect affiliates' rate of return, since they will continue in one way or another paying a fixed commission. But the second one benefits them, since they end up paying a variable commission according to performance. As can be seen, a greater menu of investment possibilities does not ensure that the Afores offer a higher yield, but it does give greater control to affiliates (not only to the Consar) and the Afores can be distinguished by their different investment style and a greater presence of advisers in the lives of the affiliates.

From passive to a proactive presence

This article began with three key questions, and it is clear that the Afores are not doing a good job: advisors are almost non-existent in the lives of the affiliates and the information provided to the contributor is incomplete. This is because the different participants in the system have much work to do: the Mexican Association of Afores (Amfore) and the Consar could help to design medium-term scenarios that allow the portfolios of the different Siefores or the different funds of the Fiefore to be determined. The rigidity in the composition of the Investment Funds must end. A variable commission brings the responsibility for a different style of investment, and there we will see how each different Afore performs.

Advisors could contact contributors on a monthly basis to make recommendations on moving between the funds for terms ranging from one to five years. The Afores could seek to differentiate their investment styles and actively propose investments in new instruments to the Consar. Additionally, contributors could acquire more financial training and monitor their investments more often. Reports must certainly be more complete and include not only the real return on investment but also the risk-adjusted return, and they must be monthly and not quarterly. We all have much work to do; let's do it!